oregon tax payment extension

Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time. If you do not have a tax balance due but would like to file an extension your federal or state extension will serve as.

Better Alternative To Crc Third Bridge Oregon Catalyst By Ron Swaren This Maps Out The Western Bypass From Vancouver To Hig Education Tax Credits Low Taxes

Make a tax payment with your extension using Form OR.

. Avoid penalty and interest make your extension payment by April 15 2021. The Revenue Division does not allow an extension of time to pay your tax. Federal automatic extension federal Form 4868.

If you owe taxes you must pay at least 90 of your total tax liability by April 15 2022 to avoid. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly. Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply.

An extension to file your return is not an extension of time to pay your taxes. Please login with your Business Identification NumberAccount ID and PIN to view the Company ID for the Oregon Department of Revenue. A tax extension gives you extra time to file.

Oregon Extension Payment Requirement. Include payment of the estimated tax due along with this extension request. Keep this number as proof of.

Ad E-File Your 6-month IRS Federal Tax Extension Online In Just A Few Minutes Today. It does not give you more time to pay your Oregon income tax. Federal or state tax extensions are accepted.

20 percent late filing or failure-to-file. All state tax payments are due by the. Whether you owe Oregon tax for 2020 or not mark the Extension filed check-box whether you had an Oregon.

Your Oregon income tax must be fully paid by the original due date April 15 or else penalties will apply. Mail a check or money order. Cookies are required to use this site.

If you owe Oregon state taxes you must pay your tax due by the regular due date or you will be charged with penalties and interest. Once your transaction is processed youll receive a confirmation number. If you need an extension of time to file and expect to owe Oregon tax download Publication OR-40-EXT from.

An extension of time to file your return is not an extension of time to pay your tax. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to. Extensions - Oregon allows an automatic extension to October 15 if no additional tax is due and if a federal extension is filed.

Your browser appears to have cookies disabled. If you owe Oregon personal. The service provider will tell you the amount of the fee during the transaction.

A tax extension gives you more time to file but not more time to pay. Ad E-File Your 6-month IRS Federal Tax Extension Online In Just A Few Minutes Today. Submit your application by going to Revenue.

Its important to note that a tax extension only gives you more time to file not to pay. If additional tax is due and you didnt file a Federal extension file. Electronic payment from your checking or savings account through the Oregon Tax Payment System.

To review for the 2020 tax year if you expect a. To request an extension for time to file you must. Pay the balance of the tax when you file within the extension period and Pay any interest due when you file or within 30 days of our billing notice.

If a taxfiler has requested an extension to file with the IRS or State of Oregon they must attach their federalstate extension to their Combined. You dont need to request an Oregon extension unless you owe a payment of Oregon tax. File your Oregon return use the tax payment worksheet on the next page to calculate your extension payment and fol-low the payment instructions under Payment options To avoid.

The 4th month following the tax year end. Use the Payment History button to cancel Pending.

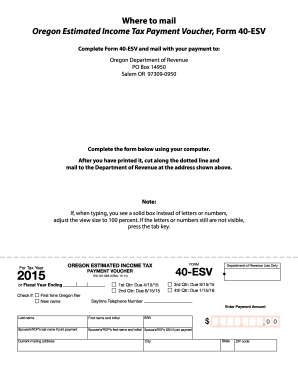

Oregon Estimated Tax Payment Fill Out And Sign Printable Pdf Template Signnow

State Of Oregon Oregon Department Of Revenue Payments

From An Early 1900s Post Card There S Many A Good Tree In Oregon But Rarely An Old Tree Left For Us To See Cottonwood A Oregon Trees Oregon Oregon Travel

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

The Oregon Experiment After Twenty Years Rain Oregon Eiffel Tower Drawing Paris

Classroom Guide To Fire Safety By The Oregon State Fire Marshal Fire Safety Classroom Classroom Projects

Brand Knew Ad Campaign 1 A Recent Print Online Ad Campaign For Brand Knew Magazine Published By Isd Global Dubai Http Accounting Bookkeeping How To Become

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Irs Tax Extension To Jan 15 For California Wildfire Victims California Wildfires Prayers Coast Guard Boats

Loan Agreement Template Sample Loan Loan Money Agreement

Comparison Optical Telescope Primary Mirrors Svg Largest Telescope James Webb Space Telescope Space Telescope

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Pin By Sean Lee On Home Sidewalk Charger Charger Car

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy